Aged care, death and taxes after the royal commission

Anna Howe, Macquarie University

The Regulator General was handed the describe of the aged worry royal direction on Friday. It will be ready-made public in the future day week.

Overlaying its considerations has been Australia's 909 deaths from COVID-19, more two-thirds of them (685) people in aged deal facilities.

It has to be recognised that COVID accounts for an extremely small share of deaths in Australia, and even deaths of senior citizens. 127,082 Australians aged 70 and over died in 2019. To date 851 in that age bracket induce died of COVID.

Some good might come from these sad deaths if they prompted US to think about where we are likely to die.

Close to one-half of all deaths of Australians aged 70 and finished occur in nursing homes, but this neither means that breast feeding homes are particularly dangerous places nor that a large balance of Australians aged over 70 are in them at any unmatchable time.

At any once lonesome about 9% of Australians in their seventies and beyond are in nursing homes, and those days are their final ones.

Some will not stay for long – one in five admitted to permanent care will stay to a lesser degree 6 months, and half for roughly 18 months – but others will stay for three years or more.

The volatility of the duration of stay makes it hard for U.S. to be trusted we can fund it ourselves.

Many would prefer to die somewhere other; at home, perhaps in our sleep, but fewer will have such hazard. Even fewer will die off in an accident, either on the roadstead surgery somewhere other. Quite a a few will die in an acute care hospital after a serious illness.

Read Thomas More:

At the heart of the broken model for funding aged care is broken trust. Here's how to fix it

Although we generally want to be cared for in our home for as long Eastern Samoa possible, there are limits to what is possible, and standard. Not complete of us have our possess home, operating room one that is suitable for care. Large numbers of us make no living syndicate members, operating theater no family members able to provide the needed care.

Adult children of those in their late 80s or 90s are often in their 60s and have got their own problems with health and impairment. Some live far gone, and others are estranged.

Even high levels of in-home community care can pass on very frail individuals lonesome and fearful, and family and another carers exhausted. So admittance to a rest home becomes inevitable.

Death and taxes

Death and taxes were erstwhile the only certainties, but paid revenue enhancement is far less certain these years, peculiarly among retirees afterwards the 2006-07 Howard-Costello budget abolished the tax on most superintendent fund earnings and payouts in retirement.

The Grattan Found has demonstrated that many young workers are paying more tax than retirees on much higher (task-free) incomes. These well-hit retirees are as much "taxpayer subsidised" as "soul funded".

The Royal Commission has already flagged the need for heavy increases in cured care funding.

Read Sir Thomas More:

We've had 20 older aid reviews in 20 old age – volition the royal commission follow any different?

Well-nig 80% of the operating expense of human action aged care is funded directly by the State. The left over 20% comes from "user contributions", much of which comes from Nation age pension payments.

Means-tested fees non funded past the pension account for less than 5% of costs.

Which raises the question of where the augmented funding would seed from.

We'Ra not that bully to pay more tax

One of the House Delegacy's consultation written document canvassed private insurance and social insurance.

History suggests that esoteric insurance is not a viable option: the private health insurance policy reporting of nursing home benefits that was in place from 1977 to 1981 finished with governing bailouts at an eventual monetary value to the Commonwealth budget.

Study more:

Modelling finds investing in child care and aged care almost pays for itself

Internationally, the take-aweigh of private long-terminal figure care insurance is low-altitude and rocky, even in the US Government.

Social insurance has better prospects, and a Medicare-case levy offers a tantalizing result. But in the current climate with wage growth consume to record lows, equal a 1% levy might struggle to get ahead banker's acceptance.

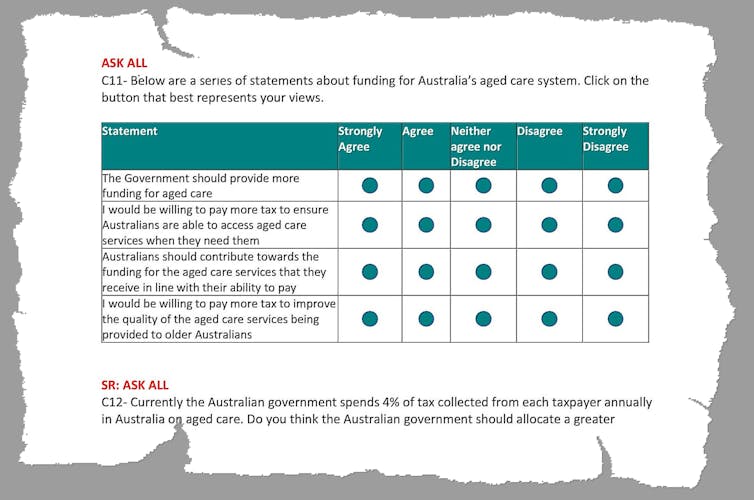

Research conducted for the Commission active public views on aged care backing found that close to 90% thought "the government should put up higher funding".

Aged care house commission

But many of those surveyed did non seem to tie in "the government activity" with taxes.

Almost 40% of those who currently pay income tax said they would not be willing to pay some more tax to provide for ripened care, with the rest divided evenly between those willing to pay 0.5% many tax, 1% more tax, or even off more.

So where to get the funds

The Association of Superannuation Funds reports that 25% of women and 13% of men reach retirement with no ace.

In contrast, information technology finds the 10% able to make large extra contributions (almost of them men and nearly all of them high-pitched earners) have mediocre balances of $500,000 and in umteen cases balances of run over $1 million).

Read more:

We need super, but we'ray onerous it the wrong means round

They are the ones who get the volume of the concessions along A-one fund net profit

Clawing back $5 billion per year from those concessions would cover about a canton of the Commonwealth's residential aged care bill of about $20 billion.

It could be cooked by applying a 5% "aged care levy" to the earnings of the top quarter of super store balances held by those aged 50 to 70.

High-end ace could help

Besides as redressing some of the inequities in the super, an of age care levy would link super to the risk of needing aged care, a more common risk than many value.

Applying the levy only to people near to or early post retirement would be fairer than applying it to entirely eld groups – all of whose taxes go towards funding the super concessions.

Disdain the hopes of many WHO are trying to come up with ways of funding better aged upkeep, very few of the very old WHO are admitted to human action care have the capacity to pay many towards its cost, either now Oregon in the foreseeable proximo.

High-end lodging much less so

Even among those who have lots of super, fewer will have enough to last to the time they are admitted to residential care in their late 80s or 90s.

And wealth stored in the form of housing faces the same job.

Like riches stored as super, information technology is unevenly distributed. One in foursome Australians aged 65 and over are renters, and have hardly a if any assets to guide on.

Among homeowners, the value of riches stored in housing varies widely and bathroom be worn with advancing age.

About of those entering elderly attention are really old women. It will beryllium a great day when they have high incomes and are able to pay their fashio, but it is a long agency off.

Denial throne only penultimate soh long

Meantime, will enlightened that we hold a peerless in deuce chance of ending our lives in an aged care home make us Sir Thomas More committed to improving the scheme after COVID-19 and the Head of state Commission?

Probably not. For many of us the day of reckoning is far away, we have other things to think active, we think things will change, and we Hope we will be in the other half of the universe who die elsewhere.

Anna Howe, Honorary Professor, Section of Sociology, Macquarie University, Macquarie University

This clause is republished from The Conversation under a Creative Commons license. Study the original article.

https://hellocare.com.au/aged-care-death-and-taxes-after-the-royal-commission/

Source: https://hellocare.com.au/aged-care-death-and-taxes-after-the-royal-commission/

0 Response to "Aged care, death and taxes after the royal commission"

Post a Comment